The Union Budget 2023 has just been presented by FM Nirmala Sitharaman, bringing with it a host of financial policies and plans aimed at boosting the Indian economy and improving the lives of its citizens. This year's budget has a focus on infrastructure development, healthcare, and agriculture, among other sectors. A special consideration also given to middle-class. As the nation eagerly waits to see the results of these measures, it's crucial to take a closer look at the budget and understand how it will impact the economy and common people. In this blog, we'll provide Key Highlights of Union Budget 2023-24. Please comment below about your analysis, potential benefits, and potential drawbacks and you see this budget as whole? We will start with Part B of Key Highlights of Union Budget 2023-24

Key Highlights of Union Budget 2023-24 (Part B)

Indirect Taxes

1. Customs duty on goods of textiles, toys, bicycle reduced from 21 to 13%2. To promote Green Mobility - basic customs duty concession for lithium ion battery

3. To promote Electronics manufacture- relief on customs duty

for camera lens and lithium battery

4. Television - TV panels customs duty reduced

5. Electric kitchen chimney to reduce inverted duty structure

from 7.5 to 15 percent

6. Benefit for ethanol blending program and acid program and

epichlorohydrine

7 Marine Products- to

promote exports - shrimps, etc. Duty on shrimpfeed reduced

8. Basic Customs duty reduced for seeds in manufacture for

diamonds

9. Customs duty to increase in silver bars

10. Steel - concessional customs duty on steel and ferrous products

11. Copper - concessional customs duty on copper

12. Rubber - concessional customs duty on rubber

13. Cigarettes - increased tax

Direct Taxes

1. Common IT form and grievance redressal system

2. MSME - avail benefit of presumptive taxation increased to

44AD to 3 crores

Professionals u/s 44ADA - 75 lakhs

Provided receipt in cash doesn't exceed 5%

3. TDS only on payment for deduction

4. Co-operatives tax

-15%

Higher limit of 2 lakh per member for cash deposit in

agricultural banks

Higher limit of Rs. 3 crores on TDS for cooperative societies

5. Startups

To avail startup benefits from 31-03-2023 to 31-03-2024

6. 100 new joint commissioners for appeal

7. S.54 to S.54F capped at 10 crores

8. TDS on Online gaming -

9. TDS 30% to 20% on taxable portion of EPF

10. Extending funds for GIFT and IFSC

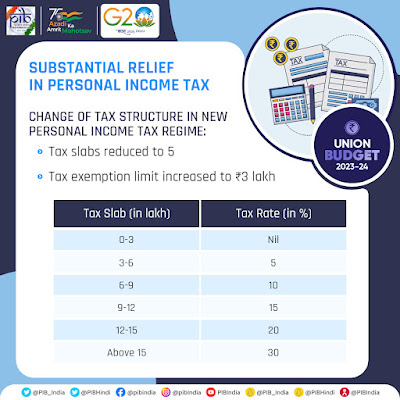

Personal Income Tax

1. Rebate for income up-to 7 lakhs u/s 87A in the new tax

regime

2. New tax regime from

0-3 lakhs nil

3-6 lakhs- 5%

6-9 lakhs 10%

9-12 lakhs 15%

12-15 lakhs 20%

Above 15 lakhs- 30 %

3. Standard deduction for new tax regime for Rs. 15.5 lakhs or more -52,500

4. Reduction of highest surcharge from 37% to 25% on new income tax regime

5. Limit on tax exemption for leave encashment is increased from 3,00,000 to 25,00,000

6. New income tax regime default regime

Key Highlights of Union Budget

2023-24.

1. EPFO Numbers doubled to 27

crores

2. Agriculture accelerator fund

to boost startup in Agri sector. Special scheme to boost fisheries

3. 38,800 teachers will be

employed in 3.5 lakh Eklavya tribal school.

4. Capital outlay of Rs. 2.40

lakh crore for Railways.

5. 50 New Airports and Heliports

to be made.

6. Rs. 10,000 crore for urban

infra fund every year

7. Rs. 75,000 crore for 100

transport infra projects

8. 3 Centers of Excellence for

“Artificial Intelligence” will be set up.

9. KYC procedure to be

simplified. PAN to be come common business identifier.

10. Scope of Digi locker to be

increased.

11. More than 39,000 compliances

reduced. Jan Vishwas Bill to amend 42 laws

12. Rs. 35,000 crore for Energy

transmission

13. 10,000 bio input research

centers to be set up.

14. 30 Skill India International

centers to be set up.

15. NFIR (National Financial

Information Registry) to be launched for financial strategy.

16. Reducing cost of MSME Credit

by 1%. Infusion of Rs. 9,000 crore in corpus for MSME credit.

17. ‘Mahila Samman Bachat Scheme’

for Women for Rs. 2,00,000 @ 7.5%

18. SCSS enhanced from 15 lakh to

30 Lakh.

Direct and Indirect tax

1. Promote domestic manufacturing

and exports.

2. Tax exemption on Capital Goods

and Lithium batteries.

3. Mobiles, camera lenses to

become cheaper.

4. Gold, Silver & Diamonds,

cigarettes, imported rubber to get expensive.

5. Enhanced limit for 3 crore and

75 lakhs for presumptive taxation.

6. Higher TDS limit of RS. 3 cr

for Cooperatives

7. New IT Return Form for easier

filing .

8. 100 Joint Commissioners to be

appointed for disposal of small appeals.

9. TDS reduced on EPF withdrawal

10. Section 54 and 54F to be

amended.

11. Rebate limit increased to 7

lakh in new tax regime.

12. Number of slabs reduced from

7 to 5 in new tax regime.

13. Only 5% tax on Individual’s

Annual income of 9,00,000 only to pay Rs. 45,000 as tax.

14. Salaried class and pensioner:

Standard Deduction increased

15. Highest tax rate 42.74 %

reduced

16. Propose to reduced Higher

surcharge rate from 37 % to 25% in new tax regime.

17. Leave Encashment: Limit

increased from Rs. 3,00,000 to Rs. 25,00,000.

Post a Comment